Many individuals participating in the crypto industry eventually have problems with their crypto tax obligations. Some individuals believe that once they enter the cryptocurrency ecosystem, they won’t have to worry about taxes, but that is not true at all.

All around the world, tax authorities undoubtedly keep an eye out on the cryptocurrency industry to ensure that crypto investors pay income taxes on any potential capital gains they make in this brand-new, developing market.

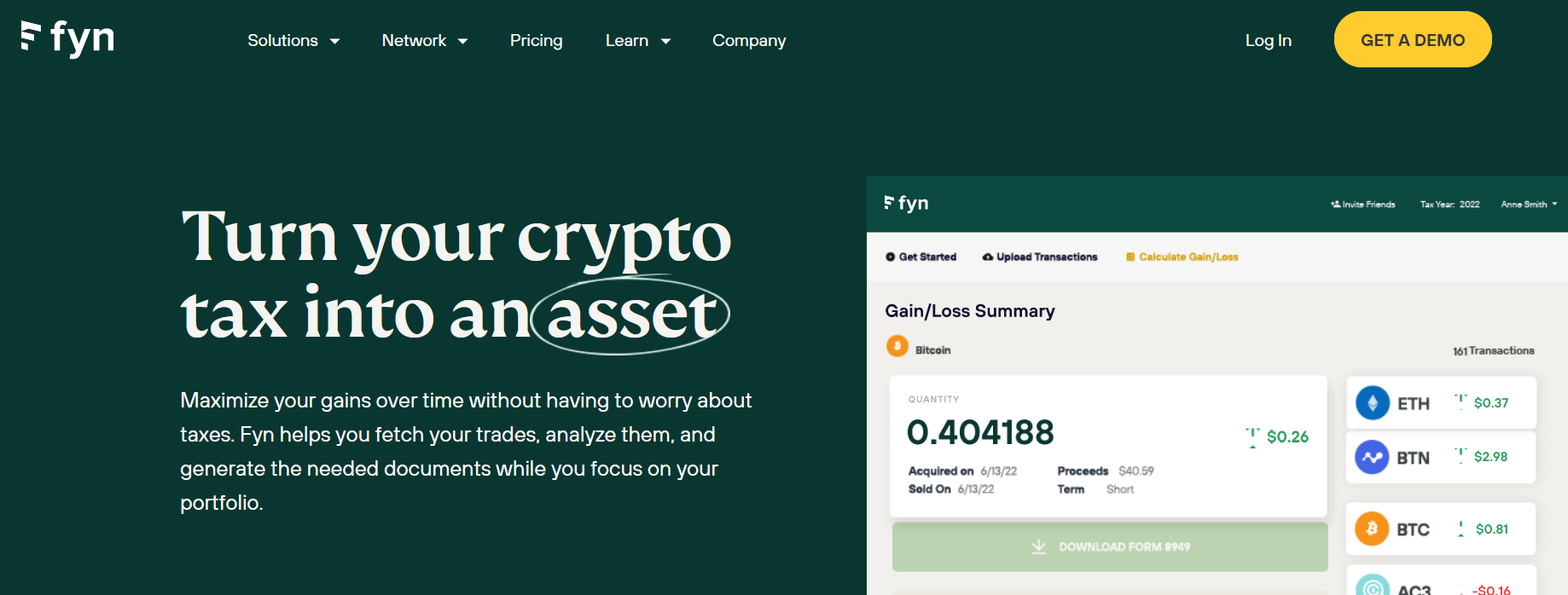

BearTax (now Fyn) and other cryptocurrency tax reporting software can be helpful in this situation.

What Is BearTax?

BearTax is a cryptocurrency tax software that eliminates the potential complications of recording all your previous crypto trades. It uses interfaces with several crypto exchange APIs to produce tax returns automatically.

Many cryptocurrency users who don’t engage in a lot of trading throughout the year may discover that BearTax is the ideal option for all of their crypto tax reporting needs, as it is one of the most reasonably priced cryptocurrency tax software available.

How Does BearTax Work?

Software for tracking crypto taxes called BearTax is beneficial for both private users and businesses with clients who frequently buy and sell cryptocurrencies.

The user imports their transaction data using an API key or CSV file, reviews every piece of data that has been added to the platform, and is then given the option to download tax documents that may be imported into conventional existing tax reporting software like TurboTax. The use of this software has been simplified into a straightforward, three-step process.

BearTax offers a variety of crypto tax tools, all of which are free to use. You only need to pay when you want to get a detailed report that you can use in a given tax year.

All investors are given access to online chat in case of any technical issues. Those with Professional accounts can get in touch with accounting professionals for additional support with their crypto taxes.

BearTax Cryptocurrency Tax Software’s Best Features

Pricing

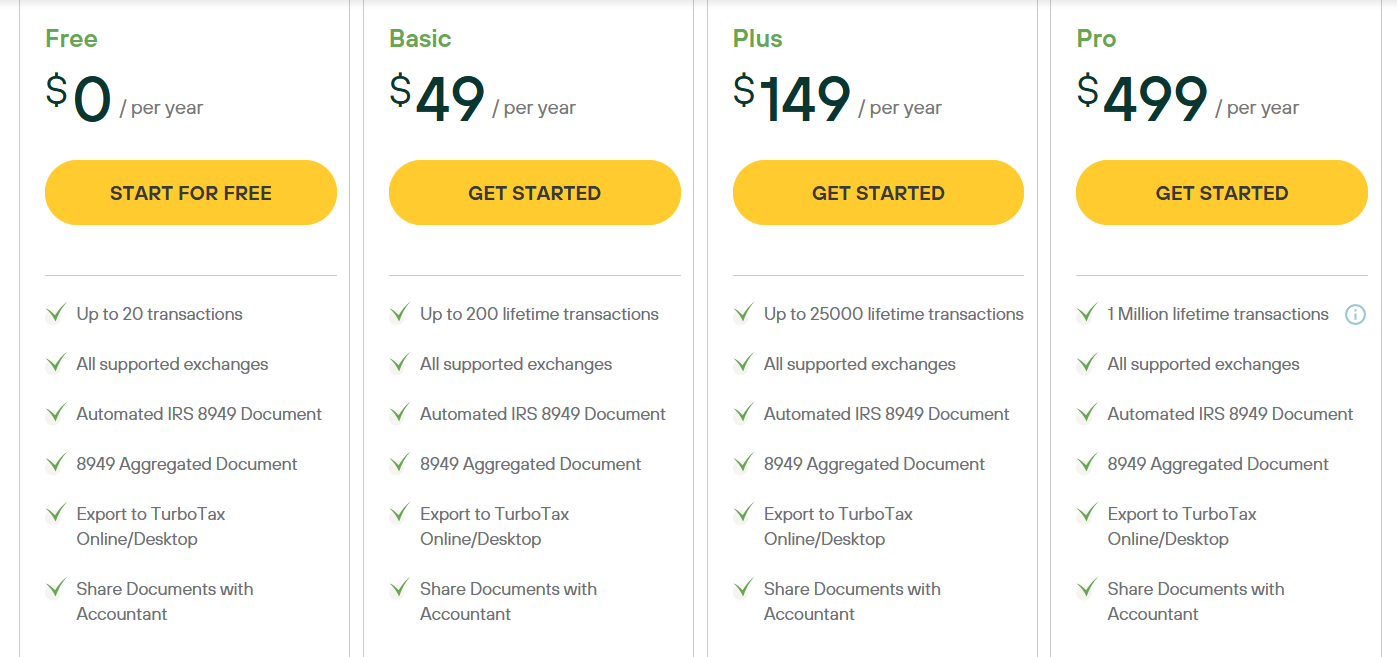

BearTax’s pricing is undoubtedly its best asset.

The crypto tax platform’s cheapest product costs just $49 a year, which is incredibly low for this market. Although this entry-level account only supports importing 20 transactions annually, the truth is that some clients who don’t trade daily may find this special offering to be a clever solution for their requirements.

Experienced traders can also take advantage of BearTax’s outstanding price structure. To get a Professional account, you only need to pay $149 annually, and it offers unlimited transactions as well as help from a real accounting firm.

User-Friendly and Seamless Integration

The smooth integration of BearTax with conventional tax reporting software is an additional fantastic feature. You won’t have any trouble using BearTax to take care of all your tax requirements relating to cryptocurrencies if you’re familiar with submitting your own taxes using software like TurboTax.

The only thing you have to do is register for a paid subscription on BearTax, integrate all of your trading data from exchanges, and then click on a button to receive a full tax report, which can be immediately added to whichever cryptocurrency tax software you use to do your taxes every year.

If you utilize BearTax to take care of your crypto capital gains, nothing else in how you file taxes would need to change.

Special Section for Accountants

Another aspect of the BearTax cryptocurrency tax software worth mentioning is that it also includes a separate section on the website for accountants who want to manage clients, individual traders, and their crypto taxation. The first three clients of an accountant who uses BearTax to handle crypto taxes don’t even need to pay the costs.

By requesting their clients to import their own trading data from the exchanges to the BearTax platform, accountants can save their clients’ privacy, which is a key benefit in the cryptocurrency market. The accountant can easily download the transaction data imported by customers and processed by the tax software.

Is This Cryptocurrency Tax Software Suitable for Beginners?

If you’re new to crypto trading and need a way to file taxes you could owe on your cryptocurrency gains, BearTax is undoubtedly a solid alternative.

The Basic account provided by BearTax is the ideal choice for those who merely purchase and hold crypto or a very small amount of other digital assets.

At an incredibly cheap price of just $49 a year, this account type enables individuals to automatically import their trades from the exchanges. Even though this account type supports a very small number of transactions, most beginners don’t regularly make many trades.

BearTax, however, may also be useful for anyone who is new to cryptocurrency and makes a lot of trades. That’s because new users can get support from a real accountant and import an unlimited number of trades from their cryptocurrency exchange accounts if they pay the $149 annual membership fee for a Professional BearTax account.

Conclusion

BearTax offers four distinct account options. Before deciding on one of these paid accounts, you can use the software for free to determine how much tax you owe.

BearTax’s cost is quite reasonable when compared to other crypto tax reporting software alternatives, particularly when it comes to Basic and Professional accounts. It should be mentioned that users can receive a discount if they buy two years’ worth of tax aid rather than just one.

If you are one of the cryptocurrency investors who want to meet their payment obligations but don’t want to drastically change their existing routines, BearTax is a brilliant solution for you.

With the help of this app, you will be able to manage your crypto tax responsibilities using your current tax planning program, such as TurboTax. You should definitely try it out as a free user first, and if it suits you well, we advise considering the paid account options, too.